Aave: Revolutionizing Decentralized Finance

Aave is a decentralized finance (DeFi) protocol that enables users to lend and borrow cryptocurrencies without relying on traditional financial intermediaries. Launched in 2020, Aave has emerged as one of the leading protocols in the DeFi space, offering innovative features that enhance the user experience and expand the possibilities of decentralized finance.

What is Aave?

Aave is an open-source protocol built on the Ethereum blockchain, allowing users to lend their assets to others and earn interest while also providing borrowers with the ability to take out loans. The platform operates using smart contracts, which automate the lending and borrowing processes, ensuring transparency and security.

Key Features of Aave

Lending and Borrowing:

Users can deposit various cryptocurrencies into Aave's liquidity pools and earn interest on their deposits. Borrowers can take loans by providing collateral, allowing for a decentralized borrowing experience.

Flash Loans:

Aave introduced the concept of flash loans, which allow users to borrow assets without collateral as long as the loan is repaid within a single transaction block. This feature is particularly useful for arbitrage opportunities and other quick trading strategies.

Variable and Stable Interest Rates:

Aave offers borrowers the choice between variable and stable interest rates. Variable rates can change based on market conditions, while stable rates provide more predictability for borrowers.

Liquidity Pools:

Users can supply assets to liquidity pools, which are then used by borrowers. The interest earned by lenders is derived from the fees paid by borrowers, creating a mutually beneficial ecosystem.

Governance:

Aave is governed by its community through the AAVE token, which allows holders to vote on protocol upgrades, changes, and other important decisions. This decentralized governance model empowers users to have a say in the platform's future.

How Aave Works

Lending Process

Deposit Assets:

Users can deposit various cryptocurrencies into Aave's liquidity pools. The protocol accepts a wide range of assets, including Ethereum, stablecoins, and other ERC-20 tokens.

Earn Interest:

Once assets are deposited, users earn interest based on the demand for those assets. The interest rates are determined algorithmically, adjusting to market dynamics.

Accessing Liquidity:

The deposited assets are made available for borrowing by other users. Lenders can withdraw their assets at any time, provided there is sufficient liquidity in the pool.

Borrowing Process

Collateralization:

To borrow from Aave, users must provide collateral, typically a cryptocurrency that is worth more than the amount they wish to borrow. This ensures that the loan is secure and reduces the risk of default.

Loan Approval:

After collateralization, users can request a loan. The amount they can borrow is determined based on the collateral value and the protocol's collateralization ratio.

Repayment:

Borrowers must repay the loan along with any accrued interest. They can choose to repay in either the same asset they borrowed or another asset, depending on the available options.

Flash Loans

Flash loans are one of Aave's most innovative features. They enable users to borrow funds without collateral, provided that the loan is repaid within the same transaction. This feature has become popular for arbitrage traders and developers who want to execute complex financial strategies without needing upfront capital.

Interest Rates

Aave employs a unique interest rate model that allows for both variable and stable rates. The variable rate fluctuates based on supply and demand dynamics, while the stable rate provides borrowers with a fixed interest rate for a set period. This flexibility allows users to choose the option that best fits their financial strategy.

AAVE Token

The AAVE token is the native governance token of the Aave protocol. It plays a crucial role in the ecosystem, providing users with voting rights and participation in governance decisions. AAVE holders can propose and vote on changes to the protocol, influencing its direction and development.

Use Cases of AAVE Token

Governance:

AAVE token holders can participate in the governance process, voting on proposals and changes to the protocol.

Staking:

Users can stake AAVE tokens to earn rewards, contributing to the protocol's security and stability.

Safety Module:

AAVE tokens can be used in the Safety Module, which acts as an insurance mechanism for the protocol. In the event of a shortfall, staked AAVE tokens can be used to cover losses, protecting liquidity providers.

Security Measures

Aave places a strong emphasis on security to protect users' funds and maintain the integrity of the protocol. Some of the key security measures include:

Smart Contract Audits:

Aave undergoes regular smart contract audits conducted by reputable firms to identify vulnerabilities and ensure the robustness of the code.

Risk Parameters:

The protocol allows for adjustable risk parameters, enabling the community to manage risk effectively based on market conditions.

Transparent Operations:

Aave operates transparently, with all transactions and smart contract interactions visible on the blockchain. This transparency builds trust among users.

Aave's Impact on DeFi

Aave has played a pivotal role in shaping the DeFi landscape. Its innovative features, such as flash loans and unique interest rate models, have inspired other projects and contributed to the overall growth of the DeFi ecosystem.

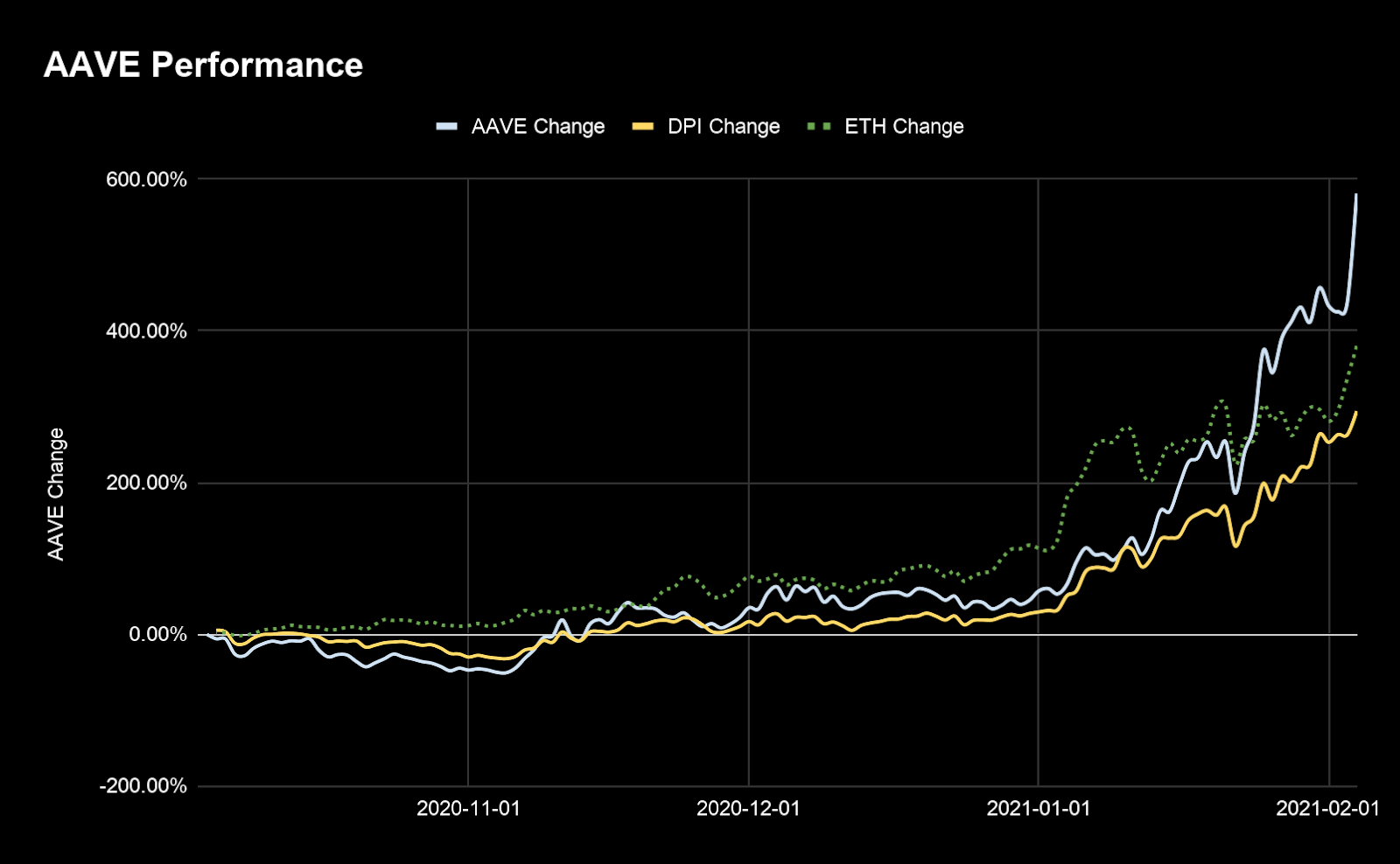

Market Position

As one of the leading DeFi protocols, Aave has consistently ranked among the top platforms in terms of total value locked (TVL). Its user-friendly interface, extensive asset support, and strong community governance have attracted a diverse range of users, from casual investors to institutional players.

Community and Ecosystem

Aave has cultivated a vibrant community of users, developers, and enthusiasts. The protocol’s governance model encourages participation and collaboration, allowing users to contribute ideas and proposals for improvement. Additionally, Aave has partnered with various projects and platforms to expand its ecosystem and offer users more opportunities.

Future Developments

Aave continues to evolve and adapt to the changing DeFi landscape. Some future developments may include:

Cross-Chain Functionality:

Expanding Aave’s reach to other blockchain networks could enhance interoperability and attract a broader user base.

Enhanced User Experience:

Continuous improvements to the user interface and experience will help make Aave more accessible to new users.

Integration of New Assets:

Adding support for additional cryptocurrencies and tokens will provide users with more options for lending and borrowing.

Advanced Financial Products:

The introduction of new financial products, such as insurance and derivatives, could further expand Aave’s offerings and utility.

Conclusion

Aave has established itself as a cornerstone of the DeFi ecosystem, offering innovative solutions for lending and borrowing in a decentralized manner. With its commitment to security, user empowerment, and continuous development, Aave is well-positioned to remain a leader in the ever-evolving world of decentralized finance.

As the DeFi landscape continues to grow, Aave's vision of a decentralized financial system where users have full control over their assets and financial decisions is becoming increasingly attainable. Whether you are a seasoned crypto investor or new to the space, Aave presents a compelling opportunity to engage with the future of finance.

aave

aave finance

aave fi

aave protocol

Aave is a decentralized lending/borrowing protocol on Ethereum and other blockchains. Users deposit crypto to earn interest or borrow assets by collateralizing their holdings. It features flash loans, variable/fixed rates, and safety mechanisms like over-collateralization. Governed by AAVE token holders, it’s a leading DeFi platform for passive income and leveraged trading.

Drag & Drop Website Builder